The stock market can be a complex and challenging place to navigate, even for adults. It's filled with numbers, charts, and constantly changing information that can be overwhelming. But don't worry, some simple tips can help you make Stock Market Predictions For Next 5 Years.

source: google.com

As we look ahead to the next five years in the stock market, here are the Stock Market Predictions For Next 5 Years that experts are making:

1. Technology Stocks on the Rise: Technology companies, like those in the field of artificial intelligence, virtual reality, and renewable energy, are expected to continue growing. As our world becomes more digital, these companies have the potential to bring innovative solutions and drive the stock market forward.

2. Sustainable Investing: Investing in companies prioritizing environmental, social, and governance (ESG) factors is becoming increasingly popular. More and more investors are seeking companies that focus on sustainability and ethical practices, leading to potential growth in these areas.

3. Healthcare Sector Boom: The healthcare sector, including pharmaceutical companies and biotechnology firms, is expected to grow significantly. Advances in medical research and technology, as well as an aging population, contribute to this positive outlook.

4. Emerging Markets: Developing countries, such as those in Asia and Latin America, are likely to experience economic growth, which can lead to opportunities for investors. As these markets expand and become more influential, investing in emerging markets could yield promising returns.

5. Volatility and Market Corrections: While there may be periods of growth, it's important to remember that the stock market can also experience volatility and corrections. Economic factors, geopolitical events, and market trends can all impact stock prices. It's crucial to stay informed, diversify investments, and maintain a long-term perspective.

Remember, these predictions are based on expert opinions and historical trends, but the stock market is unpredictable. It's essential to do thorough research, consult with financial advisors, and make informed decisions when investing.

source: google.com

If you're interested in making intelligent Stock Market Predictions For Next 5 Years, here are ten tips to consider:

1. Research: Stay informed about the companies you're interested in and the overall market trends. Read financial news, and reports, and analyze historical data.

2. Diversify Your Portfolio:Spread your risk by investing in a number of equities from various industries.

3. Long-Term Perspective: Remember that investing is a marathon, not a sprint. Long-term growth should take precedence over short-term earnings.

4. Understand Economic Factors: Keep an eye on the economy. Factors like interest rates, inflation, and unemployment can impact the stock market.

5. Follow Industry Trends: Stay updated on the latest trends in technology, healthcare, and renewable energy. Look for companies that are positioned for growth.

6. Watch for Innovation: Pay attention to companies that are developing new technologies or disrupting traditional industries. Innovation can drive stock prices up.

7. Dividend Stocks: Dividend stocks are stock shares issued by firms that distribute a part of their profits to shareholders. They can provide a consistent source of income.

8. Seek Professional Advice: Consult with financial advisors who can provide expert guidance tailored to your investment goals.

9. Be Patient: Stock market fluctuations are normal. Avoid making hasty judgments based on short-term movements.

10. Stay Positive and Stay Informed: Keep a positive mindset and stay informed about the latest market trends. Be open to learning and adapting your investment strategy.

Remember, investing in the stock market involves risks. It's important to do your due diligence, seek advice from professionals, and make decisions based on your own financial goals and risk tolerance.

When Will the Stock Market Reach Its Peak in the Next 5 Years?

source: google.com

Economic conditions, corporate performance, geopolitical events, and investor attitudes all have an impact on the stock market. These factors can be unpredictable and constantly changing.

It's important to remember that investing in the stock market involves risk, and it's not possible to accurately predict its future movements. Market peaks and downturns are a natural part of the market cycle. While some experts may offer Stock Market Predictions For Next 5 Yearsor opinions, it's crucial to approach such forecasts with caution.

Instead of trying to time the market or predict its peak, it's generally recommended to focus on long-term investing strategies. Diversifying your portfolio, investing in quality companies, and staying informed about market trends can help you make sound investment decisions.

If you're considering investing in the stock market, it's advisable to consult with a financial advisor who can provide personalized guidance based on your circumstances and goals. They can help you develop a strategy that aligns with your risk tolerance and long-term objectives.

Which share will increase in next 3 months?

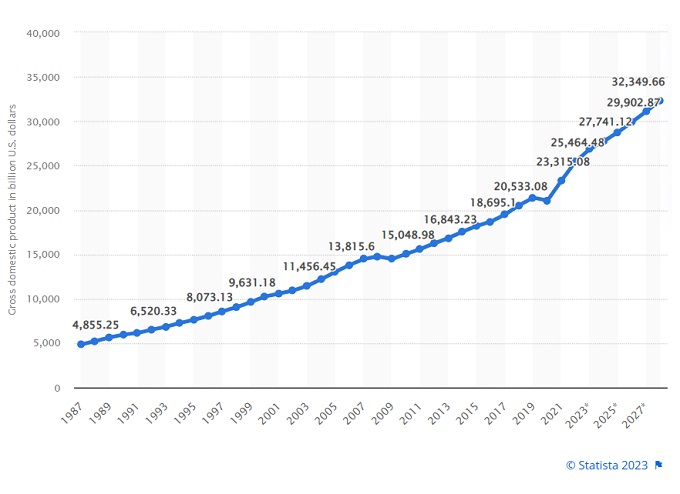

Here are the 5 Year Stock Market Outlookfor the USA:

1. Equities maintaining their long-term appeal: Despite short-term fluctuations, stocks are expected to remain attractive for long-term investors.

2. Returns driven by stock specifics: The performance of individual stocks will have a greater impact on overall returns rather than broad market movements.

3. Emphasizing quality and stability: Investing in high-quality stocks that demonstrate resilience and have positive fundamentals is recommended.

4. Selective risk-taking: Considering macro factors that influence market sentiment while being cautious in taking investment risks.

5. Company specifics driving returns: As clarity emerges around inflation and the economy, the focus will shift towards individual company performance as a driver of returns.

Note the importance of stocks in a well-balanced investment portfolio, even though both stocks and bonds delivered negative returns in 2022. It is suggested that stocks continue to play a paramount role in long-term investment programs.

Additionally, note the concept of equity risk premium, which measures the relative risk-reward between stocks and bonds. Stock pricing compared to bonds is currently slightly better than historical averages, suggesting that stores may offer better long-term returns.

Overall, the 5 Year Stock Market Outlook suggest that investors should focus on quality stocks, dividend growers, and stability sectors such as healthcare. However, it's important to note that these predictions should be considered alongside personal research and advice from financial professionals before making any investment decisions.

Written by- Ananya Majumdar