Expansion estimated by buyer cost file (CPI) is characterized as the adjustment of the costs of a crate of labor and products that are regularly bought by unambiguous gatherings of families. Expansion is estimated as far as the yearly development rate and in list, 2015 base year with a breakdown for food, energy and complete barring food and energy.

Expansion estimates the disintegration of expectations for everyday comforts. A shopper cost record is assessed as a progression of rundown proportions of the period-to-period relative change in the costs of a proper arrangement of buyer labor and products of consistent amount and qualities, gained, utilized or paid for by the reference populace.

Every synopsis measure is built as a weighted normal of countless rudimentary total lists. Every one of the rudimentary total lists is assessed involving an example of costs for a characterized set of labor and products got in, or by occupants of, a particular district from a given arrangement of outlets or different wellsprings of utilization labor and products.

What Is the Consumer Price Index (CPI)?

The Buyer Value Record (CPI) gauges the month to month change in costs paid by U.S. shoppers. The Department of Work Insights (BLS) computes the CPI as a weighted normal of costs for a bin of labor and products illustrative of total U.S. purchaser spending.

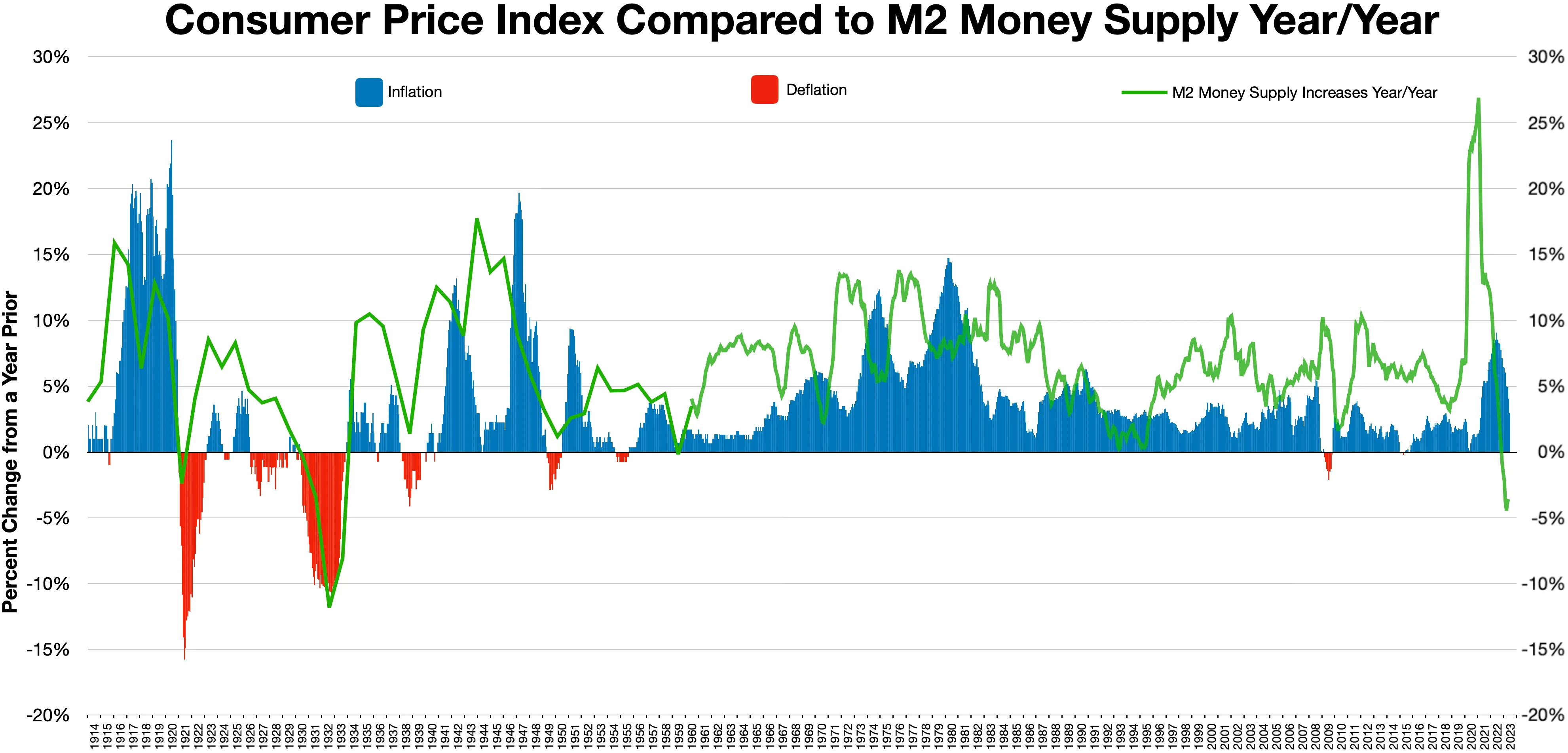

The CPI is one of the most well known proportions of expansion and collapse. The CPI report utilizes an alternate study philosophy, value tests, and record loads than the maker cost file (PPI), which estimates changes in the costs got by U.S. makers of labor and products.

Key Takeaways

The Customer Value File estimates the general change in buyer costs in view of a delegate crate of labor and products over the long run. || The CPI is the most generally utilized proportion of expansion, firmly followed by policymakers, monetary business sectors, organizations, and purchasers.

The generally cited CPI depends on a file covering 93% of the U.S. populace, while a connected file covering breadwinners and administrative laborers is utilized for typical cost for most everyday items changes in accordance with government benefits.

The CPI depends on around 80,000 cost statements gathered month to month from approximately 23,000 retail and administration foundations as well as 50,000 rental lodging units. || Lodging rents are utilized to gauge the adjustment of sanctuary costs including proprietor involved lodging that records for about 33% of the CPI.

Understanding the Consumer Price Index (CPI)

The BLS gathers around 80,000 costs month to month from approximately 23,000 retail and administration foundations. Albeit the two CPI records determined from the information both contain the word metropolitan, the more expansive based and broadly refered to of the two covers 93% of the U.S. populace.

Cover classification costs representing 33% of the general CPI depend on a review of rental costs for 50,000 lodging units, which is then used to work out the ascent in rental costs as well as proprietors' reciprocals.

:max_bytes(150000):strip_icc()/consumerpriceindex-FINAL-700b87f61f1441419c9d1562e6537f86.png)

The proprietors' identical classification models the lease comparable for proprietor involved lodging to appropriately reflect lodging costs' portion of shopper spending. Client expenses and deals or extract charges are incorporated, while personal duties and the costs of speculations like stocks, securities, or life coverage arrangements are not piece of the CPI.

The estimation of the CPI files from the information factors in replacement impacts — purchasers' propensity to move spending away from items and classes has become generally more costly.

It likewise changes cost information for changes in item quality and highlights. The weighting of the item and administration classes in the CPI files compares to late buyer spending designs got from a different study.

Types of Consumer Price Indexes (CPIs)

The BLS distributes two records every month. The Shopper Value Record for Every single Metropolitan Customer (CPI-U) addresses 93% of the U.S. populace not living in far off rustic regions.

It doesn't cover spending by individuals residing in ranch families, establishments, or on army installations. CPI-U is the premise of the broadly revealed CPI numbers that make a difference to monetary business sectors.

The BLS additionally distributes the Purchaser Value List for Metropolitan Breadwinners and Administrative Laborers (CPI-W). The CPI-W covers 29% of the U.S. populace residing in families with pay got dominatingly from administrative business or occupations with a time-based compensation.

CPI-W is utilized to change Government managed retirement installments as well as other administrative advantages and benefits for changes in the typical cost for most everyday items. It likewise moves government personal duty sections to guarantee citizens aren't exposed to a higher minimal rate because of expansion.

Consumer Price Index (CPI) Formulas

The more normal CPI-U estimation involves two essential equations. The first is utilized to decide the ongoing expense of the weighted typical container of items, while the second is utilized to investigate the year-over-year change.

Annual Formula

To work out the yearly CPI, the BLS separates the worth of a particular bin of merchandise today contrasted with one year prior:

As verified over, the bin of labor and products utilized in the CPI estimation is a composite of well known things usually bought by Americans. The heaviness of every part of the bushel is with respect to how they are sold. The yearly CPI is accounted for overall number, and the figure is frequently more noteworthy than 100 (expecting current market costs are appreciating).

The expansion rate can be determined for a given month or yearly period; regardless, the proper new and earlier period should be chosen. The expansion rate is accounted for as a rate and is much of the time positive (expecting current market costs are appreciating).

Consumer Price Index (CPI) Categories

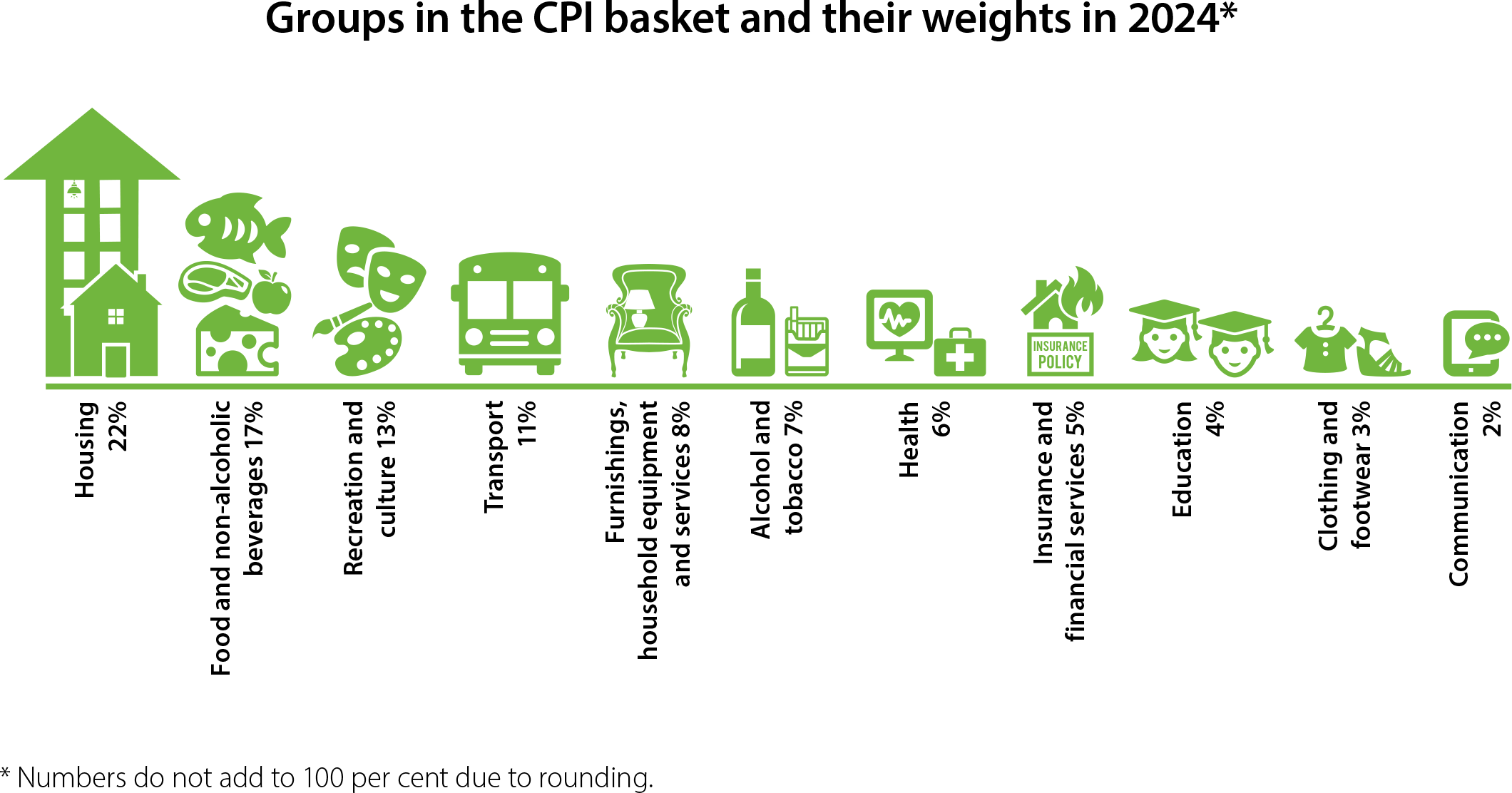

The month to month CPI discharge from the BLS leads with the change from the earlier month for the general CPI-U as well as its key subcategories, alongside the unadjusted change year-over-year. The BLS itemized tables show cost changes for various labor and products coordinated by eight umbrella spending classes.

Subcategories gauge cost changes for everything from tomatoes and salad dressing to auto fixes and games tickets. Cost change for each subcategory is furnished with and without occasional change.

Notwithstanding the public CPI records, BLS distributes CPI information for U.S. locales, sub-districts, and significant metropolitan regions. The metro information is dependent upon more extensive vacillations and is valuable primarily for recognizing cost changes in light of nearby circumstances.

How Is the Consumer Price Index (CPI) Used?

The CPI is broadly utilized by monetary market members to measure expansion and by the Central bank to adjust its money related approach. Organizations and buyers likewise utilize the CPI to go with informed financial choices. Since CPI estimates the adjustment of customers' buying power, it is in many cases a critical figure pay exchanges.

Read Also : Why does my Apple CarPlay not work all the time?

Expansion estimated by buyer cost file (CPI) is characterized as the adjustment of the costs of a crate of labor and products that are regularly bought by unambiguous gatherings of families. Expansion is estimated as far as the yearly development rate and in list, 2015 base year with a breakdown for food, energy and complete barring food and energy.

Expansion estimates the disintegration of expectations for everyday comforts. A shopper cost record is assessed as a progression of rundown proportions of the period-to-period relative change in the costs of a proper arrangement of buyer labor and products of consistent amount and qualities, gained, utilized or paid for by the reference populace.

Every synopsis measure is built as a weighted normal of countless rudimentary total lists. Every one of the rudimentary total lists is assessed involving an example of costs for a characterized set of labor and products got in, or by occupants of, a particular district from a given arrangement of outlets or different wellsprings of utilization labor and products.

What Is the Consumer Price Index (CPI)?

The Buyer Value Record (CPI) gauges the month to month change in costs paid by U.S. shoppers. The Department of Work Insights (BLS) computes the CPI as a weighted normal of costs for a bin of labor and products illustrative of total U.S. purchaser spending.

The CPI is one of the most well known proportions of expansion and collapse. The CPI report utilizes an alternate study philosophy, value tests, and record loads than the maker cost file (PPI), which estimates changes in the costs got by U.S. makers of labor and products.

Key Takeaways

The Customer Value File estimates the general change in buyer costs in view of a delegate crate of labor and products over the long run. || The CPI is the most generally utilized proportion of expansion, firmly followed by policymakers, monetary business sectors, organizations, and purchasers.

The generally cited CPI depends on a file covering 93% of the U.S. populace, while a connected file covering breadwinners and administrative laborers is utilized for typical cost for most everyday items changes in accordance with government benefits.

The CPI depends on around 80,000 cost statements gathered month to month from approximately 23,000 retail and administration foundations as well as 50,000 rental lodging units. || Lodging rents are utilized to gauge the adjustment of sanctuary costs including proprietor involved lodging that records for about 33% of the CPI.

Understanding the Consumer Price Index (CPI)

The BLS gathers around 80,000 costs month to month from approximately 23,000 retail and administration foundations. Albeit the two CPI records determined from the information both contain the word metropolitan, the more expansive based and broadly refered to of the two covers 93% of the U.S. populace.

Cover classification costs representing 33% of the general CPI depend on a review of rental costs for 50,000 lodging units, which is then used to work out the ascent in rental costs as well as proprietors' reciprocals.

The proprietors' identical classification models the lease comparable for proprietor involved lodging to appropriately reflect lodging costs' portion of shopper spending. Client expenses and deals or extract charges are incorporated, while personal duties and the costs of speculations like stocks, securities, or life coverage arrangements are not piece of the CPI.

The estimation of the CPI files from the information factors in replacement impacts — purchasers' propensity to move spending away from items and classes has become generally more costly.

It likewise changes cost information for changes in item quality and highlights. The weighting of the item and administration classes in the CPI files compares to late buyer spending designs got from a different study.

Types of Consumer Price Indexes (CPIs)

The BLS distributes two records every month. The Shopper Value Record for Every single Metropolitan Customer (CPI-U) addresses 93% of the U.S. populace not living in far off rustic regions.

It doesn't cover spending by individuals residing in ranch families, establishments, or on army installations. CPI-U is the premise of the broadly revealed CPI numbers that make a difference to monetary business sectors.

The BLS additionally distributes the Purchaser Value List for Metropolitan Breadwinners and Administrative Laborers (CPI-W). The CPI-W covers 29% of the U.S. populace residing in families with pay got dominatingly from administrative business or occupations with a time-based compensation.

CPI-W is utilized to change Government managed retirement installments as well as other administrative advantages and benefits for changes in the typical cost for most everyday items. It likewise moves government personal duty sections to guarantee citizens aren't exposed to a higher minimal rate because of expansion.

Consumer Price Index (CPI) Formulas

The more normal CPI-U estimation involves two essential equations. The first is utilized to decide the ongoing expense of the weighted typical container of items, while the second is utilized to investigate the year-over-year change.

Annual Formula

To work out the yearly CPI, the BLS separates the worth of a particular bin of merchandise today contrasted with one year prior:

As verified over, the bin of labor and products utilized in the CPI estimation is a composite of well known things usually bought by Americans. The heaviness of every part of the bushel is with respect to how they are sold. The yearly CPI is accounted for overall number, and the figure is frequently more noteworthy than 100 (expecting current market costs are appreciating).

The expansion rate can be determined for a given month or yearly period; regardless, the proper new and earlier period should be chosen. The expansion rate is accounted for as a rate and is much of the time positive (expecting current market costs are appreciating).

Consumer Price Index (CPI) Categories

The month to month CPI discharge from the BLS leads with the change from the earlier month for the general CPI-U as well as its key subcategories, alongside the unadjusted change year-over-year. The BLS itemized tables show cost changes for various labor and products coordinated by eight umbrella spending classes.

Subcategories gauge cost changes for everything from tomatoes and salad dressing to auto fixes and games tickets. Cost change for each subcategory is furnished with and without occasional change.

Notwithstanding the public CPI records, BLS distributes CPI information for U.S. locales, sub-districts, and significant metropolitan regions. The metro information is dependent upon more extensive vacillations and is valuable primarily for recognizing cost changes in light of nearby circumstances.

How Is the Consumer Price Index (CPI) Used?

The CPI is broadly utilized by monetary market members to measure expansion and by the Central bank to adjust its money related approach. Organizations and buyers likewise utilize the CPI to go with informed financial choices. Since CPI estimates the adjustment of customers' buying power, it is in many cases a critical figure pay exchanges.

Read Also : Why does my Apple CarPlay not work all the time?