We are explorer prices actual estate agents with a C employability rating, meaning this career must provide slight employment possibilities for the foreseeable destiny. Over the following 10 years, it's far anticipated america will need 18,six hundred real estate agents. That quantity is primarily based on 15,000 extra real estate marketers, and the retirement of three,six hundred existing real estate marketers.

Are Actual Estate Sellers in Demand?

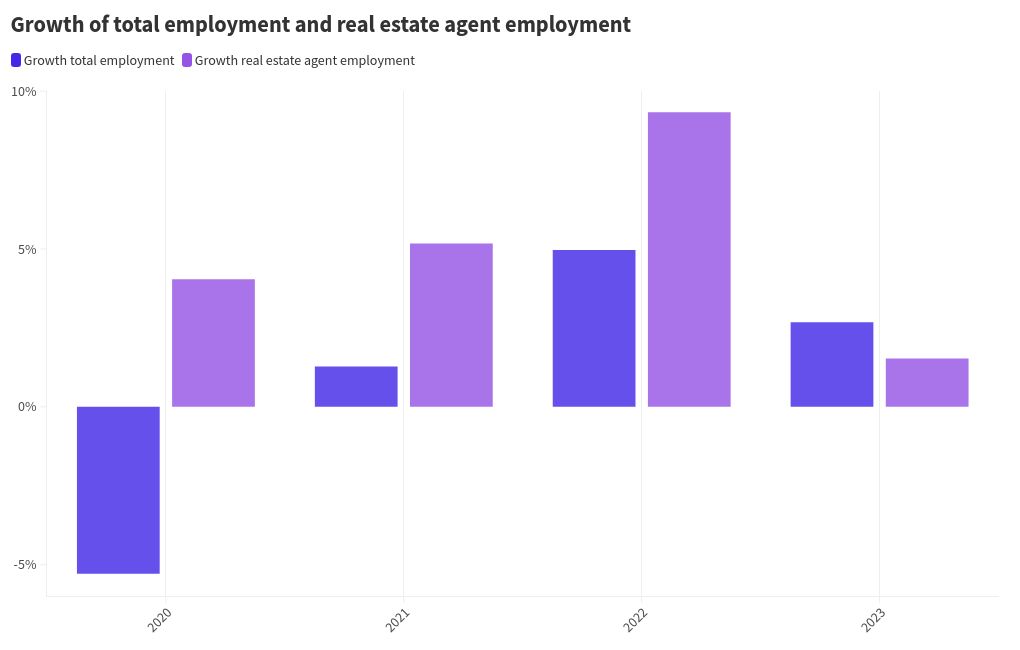

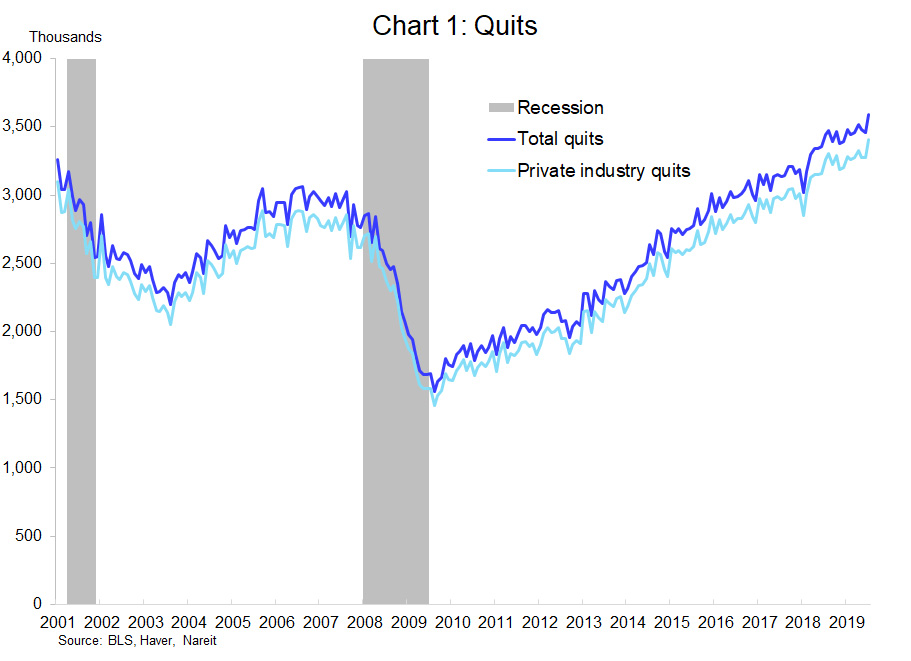

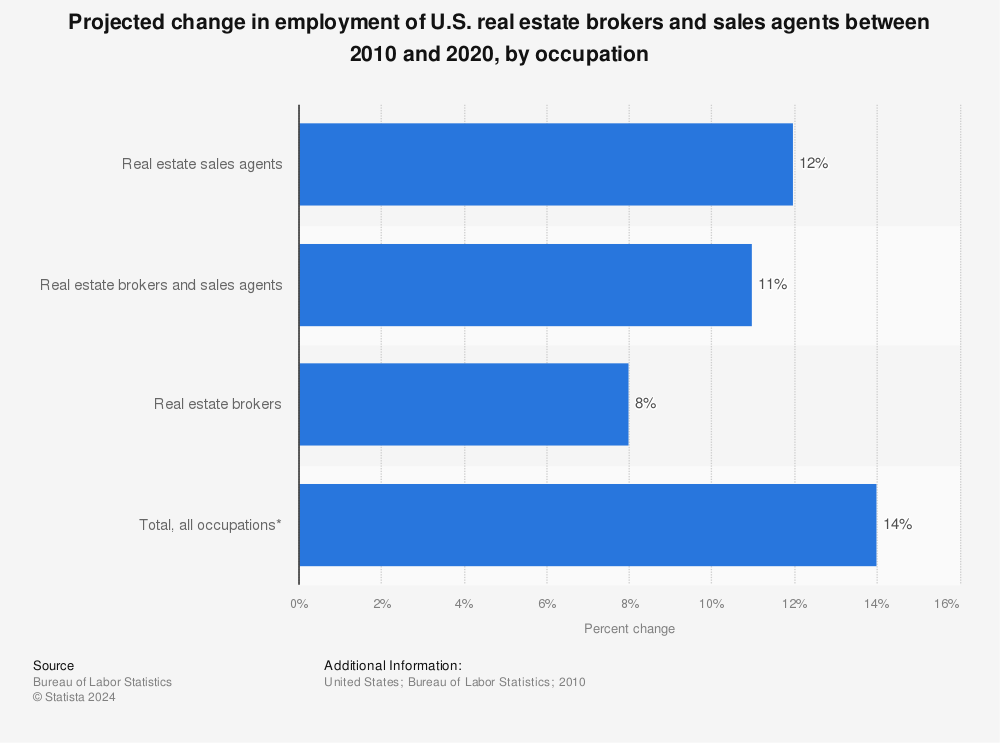

Employment of actual property agents is touchy to swings in the universal economic system, the health of the actual property marketplace, and in particular to fluctuations in interest rates. As financial activity declines and interest quotes upward thrust, the volume of sales and the subsequent demand for sellers falls.

Read Also: How Many Jobs Are Available in Real Estate Investment Trusts 2025?

This profession is highly smooth to go into, allows for bendy running situations, and gives high profits ability – factors which historically attracted retired human beings and people seeking element-time careers. However, increasingly complicated licensing and prison requirements associated with the industry are reducing the quantity of part-time agents.

New entrants to the sector evidently face intense opposition from their skilled counterparts. Increased generation, which is enhancing the productivity of hooked up agents, may additionally impact the rate at which new dealers be triumphant inside the field.

In wellknown, developing housing wishes, notion that actual estate is a valid investment, and low interest fees should hold to stimulate actual property income and the activity market for agents. Well-educated and motivated entrants with sales savvy and social and commercial enterprise connections in their groups stand to have the finest achievement.

The excessive fee of borrowing hasn’t helped both. Mortgage hobby fees have nearly tripled from round three percentage during the pandemic to 8 percentage in October 2023. Rates have given that retreated, however even at 6.Forty six percentage a 16-month low they’re nevertheless now not entirely buyer pleasant. The common month-to-month charge on a brand new mortgage might take over one-third (34.Four percent) of a borrower’s earnings (the usage of the national median), in line with ICE Mortgage Technology.

Nor are current homeowners happy. More than 1/2 of them (fifty two percentage) say they would want a loan price lower than 6 percentage to be encouraged to buy a home this yr, Bankrate’s Mortgage Rates Survey determined. They don’t need to lose their modern low-low loans.

Still, there seems to be at least some possibility on the horizon. A July document from Redfin says homebuyers on a $3,000 monthly finances have won $22,500 in shopping energy due to the fact rates were at their most recent top in April.

In other phrases, homebuyers can now have enough money a $447,750 domestic, while only some quick months in the past that same homebuyer would have been restricted to a domestic rate of $425,500, thanks to loan fees that have been within the neighborhood of seven.5 percent at that factor.

Read Also: How to Invest Enterprise Property Management Springfield MO?

Given such market realities, it’s no longer altogether shocking that Americans now want a six-discern income to come up with the money for a median-priced domestic in nearly half of of U.S. States, in keeping with Bankrate’s Home Affordability Study greater than $a hundred and ten,000 to be genuine. Four years ago, only six states and Washington D.C. Required a earnings that excessive to have enough money an average-priced domestic.

Amid this form of statistics, 20 percent of aspiring homeowners think they may never be capable of store sufficient to purchase a home, in line with Bankrate’s Down Payment Survey.

Like many other components of the U.S. Economic system, however, the housing market continuously fluctuates, based totally on consumer demand, loan hobby quotes, inflation and amount of available inventory, amid other dynamics. Let’s study the key records and facts to higher inform current and destiny homeowners.

Quarterly Homeownership Charges With the Aid of Populace Percent

Typically, there may be incremental motion in homeownership statistics over the years. However, homeownership fees are issue to volatility for the duration of most important economic events. For example, after peaking at sixty nine percent in 2004, the Great Recession (2007-09) led to homeownership prices declining, falling to just 63.Four percent with the aid of 2016.

Related Article: What Are The Risks Of Investing In Pedrovazpaulo Real Estate?

As homeownership commenced to slowly get better, the rate peaked once more at 67.9 percent within the 2nd sector of 2020 before falling to 65.5 percentage on the quit of 2021, maximum in all likelihood due to the pandemic. As of Q2 2024, the homeownership fee remains within the same statistical range: sixty five.6 percent.

Read Also : Is SpaceX Rescuing the Stranded Astronauts?

We are explorer prices actual estate agents with a C employability rating, meaning this career must provide slight employment possibilities for the foreseeable destiny. Over the following 10 years, it's far anticipated america will need 18,six hundred real estate agents. That quantity is primarily based on 15,000 extra real estate marketers, and the retirement of three,six hundred existing real estate marketers.

Are Actual Estate Sellers in Demand?

Employment of actual property agents is touchy to swings in the universal economic system, the health of the actual property marketplace, and in particular to fluctuations in interest rates. As financial activity declines and interest quotes upward thrust, the volume of sales and the subsequent demand for sellers falls.

Read Also: How Many Jobs Are Available in Real Estate Investment Trusts 2025?

This profession is highly smooth to go into, allows for bendy running situations, and gives high profits ability – factors which historically attracted retired human beings and people seeking element-time careers. However, increasingly complicated licensing and prison requirements associated with the industry are reducing the quantity of part-time agents.

New entrants to the sector evidently face intense opposition from their skilled counterparts. Increased generation, which is enhancing the productivity of hooked up agents, may additionally impact the rate at which new dealers be triumphant inside the field.

In wellknown, developing housing wishes, notion that actual estate is a valid investment, and low interest fees should hold to stimulate actual property income and the activity market for agents. Well-educated and motivated entrants with sales savvy and social and commercial enterprise connections in their groups stand to have the finest achievement.

The excessive fee of borrowing hasn’t helped both. Mortgage hobby fees have nearly tripled from round three percentage during the pandemic to 8 percentage in October 2023. Rates have given that retreated, however even at 6.Forty six percentage a 16-month low they’re nevertheless now not entirely buyer pleasant. The common month-to-month charge on a brand new mortgage might take over one-third (34.Four percent) of a borrower’s earnings (the usage of the national median), in line with ICE Mortgage Technology.

Nor are current homeowners happy. More than 1/2 of them (fifty two percentage) say they would want a loan price lower than 6 percentage to be encouraged to buy a home this yr, Bankrate’s Mortgage Rates Survey determined. They don’t need to lose their modern low-low loans.

Still, there seems to be at least some possibility on the horizon. A July document from Redfin says homebuyers on a $3,000 monthly finances have won $22,500 in shopping energy due to the fact rates were at their most recent top in April.

In other phrases, homebuyers can now have enough money a $447,750 domestic, while only some quick months in the past that same homebuyer would have been restricted to a domestic rate of $425,500, thanks to loan fees that have been within the neighborhood of seven.5 percent at that factor.

Read Also: How to Invest Enterprise Property Management Springfield MO?

Given such market realities, it’s no longer altogether shocking that Americans now want a six-discern income to come up with the money for a median-priced domestic in nearly half of of U.S. States, in keeping with Bankrate’s Home Affordability Study greater than $a hundred and ten,000 to be genuine. Four years ago, only six states and Washington D.C. Required a earnings that excessive to have enough money an average-priced domestic.

Amid this form of statistics, 20 percent of aspiring homeowners think they may never be capable of store sufficient to purchase a home, in line with Bankrate’s Down Payment Survey.

Like many other components of the U.S. Economic system, however, the housing market continuously fluctuates, based totally on consumer demand, loan hobby quotes, inflation and amount of available inventory, amid other dynamics. Let’s study the key records and facts to higher inform current and destiny homeowners.

Quarterly Homeownership Charges With the Aid of Populace Percent

Typically, there may be incremental motion in homeownership statistics over the years. However, homeownership fees are issue to volatility for the duration of most important economic events. For example, after peaking at sixty nine percent in 2004, the Great Recession (2007-09) led to homeownership prices declining, falling to just 63.Four percent with the aid of 2016.

Related Article: What Are The Risks Of Investing In Pedrovazpaulo Real Estate?

As homeownership commenced to slowly get better, the rate peaked once more at 67.9 percent within the 2nd sector of 2020 before falling to 65.5 percentage on the quit of 2021, maximum in all likelihood due to the pandemic. As of Q2 2024, the homeownership fee remains within the same statistical range: sixty five.6 percent.

Read Also : Is SpaceX Rescuing the Stranded Astronauts?