Social Impact Bonds (SIBs) are innovative monetary devices designed to fund social applications through linking funding to specific results. They constitute a new way to deal with complicated social demanding situations by means of leveraging non-public capital to fund government programs that aim to enhance societal consequences. But who precisely can problem these bonds? Let’s dive into the entities involved in issuing Social Bonds.

Related: Should I invest in high-yield corporate bonds?

5 Platforms For Investing In Social Impact Bonds

1. Government Agencies

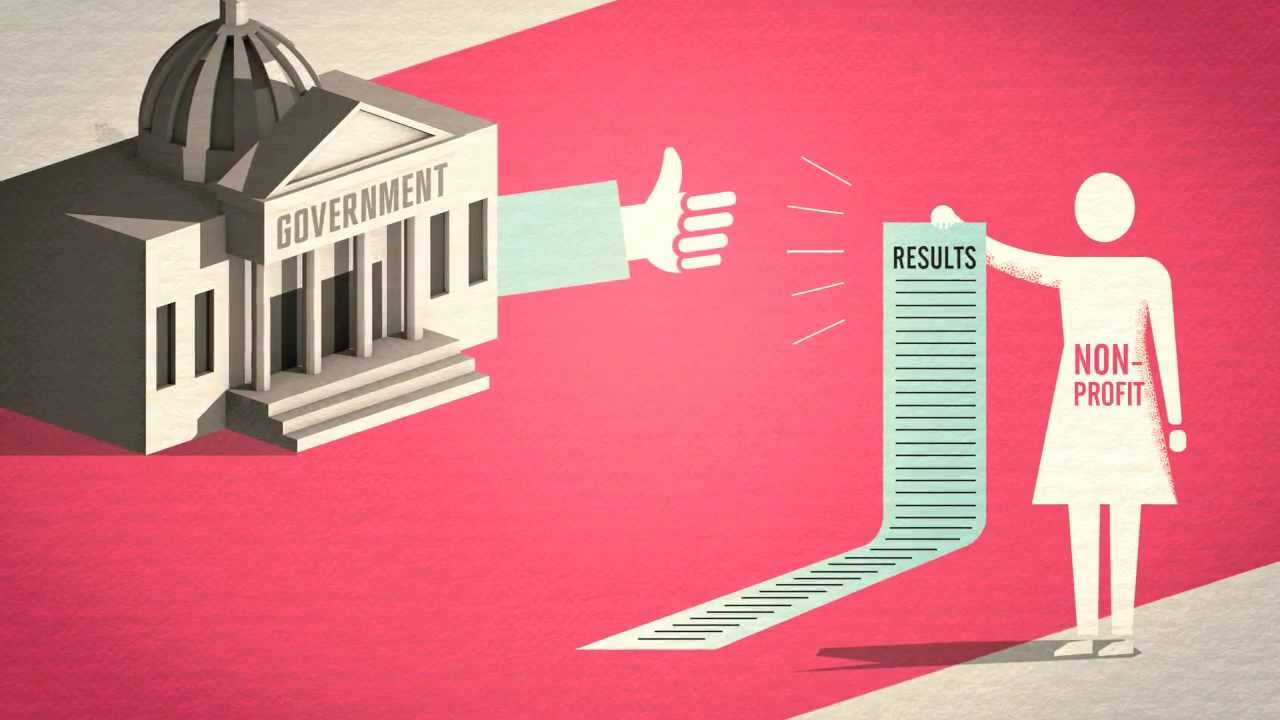

In most instances, authorities entities at the local, kingdom, or federal stage are the primary issuers of Social Impact Bonds. The position of the authorities is relevant to the method, as they're those that set the social outcomes and dreams that the bond will cope with.

Governments often associate with intermediaries (together with non-income or social establishments) and investors to fund tasks aimed toward addressing problems like homelessness, healthcare, education, and criminal justice reform. The authorities promises to repay traders if this system meets the predefined social results, commonly with a charge of go back on their investment.

Examples of government involvement:

UK: The first Social Impact Bond, issued in 2010, become applied by the United Kingdom Ministry of Justice to reduce recidivism charges amongst released prisoners.

USA: Several states inside the U.S. Have launched SIBs to enhance results in early early life training and re-entry packages for ex-offenders.

2. Non-Governmental Organizations (NGOs) and Social Enterprises

Non-profits, social companies, and different NGOs can also play a function in issuing or facilitating the issuance of SIBs. These corporations commonly act because the "intermediaries" among the investors and the social applications which are being funded.

NGOs may discover the social issue to address, layout the intervention packages, and partner with governments and investors to issue the bond. Their position is critical in ensuring this system’s success, as they regularly supply the offerings or consequences which can be being funded.

Example:

A non-profit targeted on reducing homelessness may additionally design a software that allows homeless individuals access housing and job training, after which work with the authorities and investors to problem a Social Impact Bond to fund this system.

3. Private Sector Investors

While private buyers do not at once difficulty Social Impact Bonds, they play a important function in funding them. Investors, which can encompass task capitalists, effect investors, or institutional traders, provide the upfront capital required to fund social programs. In alternate, they are paid lower back over time primarily based on the a hit fulfillment of the agreed-upon social results.

Investors benefit from the bond by way of receiving returns on their investments if the social program meets its goals. These returns are normally better than conventional bonds if the effects are met, making SIBs an attractive opportunity for effect-pushed buyers.

You May Also Like: Is it a good idea to invest in savings bonds?

4. Intermediary Organizations

In many cases, intermediary groups are involved in coordinating the issuance of a Social Impact Bond. These intermediaries facilitate relationships between the authorities, provider carriers, and traders. They can be chargeable for handling the assignment, monitoring results, and ensuring transparency during the method.

Intermediaries help structure the economic elements of SIBs and are essential for ensuring that traders are paid only whilst the favored consequences are met. Their position is pivotal in making sure the fulfillment of these bonds, which relies on right assessment and tracking of the social interventions.

5. Philanthropic Organizations

Philanthropic foundations and charitable corporations may additionally play a role in the issuance of SIBs, specifically on the subject of supporting the upfront capital needed to release a social program. These companies regularly act as "first-loss" traders, covering a part of the chance to attract other buyers.

Philanthropic involvement can assist bridge the investment gap, in particular for social applications that concentrate on marginalized or inclined populations. Foundations may additionally assist layout the interventions, ensuring that the social impact is significant and aligned with their missions.

Conclusion

Social Impact Bonds are an thrilling device inside the international of social finance, however they require collaboration from multiple sectors to achieve success. Governments, non-income, private traders, and middleman groups all play critical roles in issuing and implementing SIBs. By pooling collectively assets from diverse stakeholders, Social Impact Bonds offer an progressive way to cope with social issues, create sustainable solutions, and pressure fantastic trade.

Whether you're a central authority enterprise seeking to fund social effects or an investor interested in supporting significant causes, the arena of Social Impact Bonds gives ample possibilities for making an effect with your capital.

Social Impact Bonds (SIBs) are innovative monetary devices designed to fund social applications through linking funding to specific results. They constitute a new way to deal with complicated social demanding situations by means of leveraging non-public capital to fund government programs that aim to enhance societal consequences. But who precisely can problem these bonds? Let’s dive into the entities involved in issuing Social Bonds.

Related: Should I invest in high-yield corporate bonds?

5 Platforms For Investing In Social Impact Bonds

1. Government Agencies

In most instances, authorities entities at the local, kingdom, or federal stage are the primary issuers of Social Impact Bonds. The position of the authorities is relevant to the method, as they're those that set the social outcomes and dreams that the bond will cope with.

Governments often associate with intermediaries (together with non-income or social establishments) and investors to fund tasks aimed toward addressing problems like homelessness, healthcare, education, and criminal justice reform. The authorities promises to repay traders if this system meets the predefined social results, commonly with a charge of go back on their investment.

Examples of government involvement:

UK: The first Social Impact Bond, issued in 2010, become applied by the United Kingdom Ministry of Justice to reduce recidivism charges amongst released prisoners.

USA: Several states inside the U.S. Have launched SIBs to enhance results in early early life training and re-entry packages for ex-offenders.

2. Non-Governmental Organizations (NGOs) and Social Enterprises

Non-profits, social companies, and different NGOs can also play a function in issuing or facilitating the issuance of SIBs. These corporations commonly act because the "intermediaries" among the investors and the social applications which are being funded.

NGOs may discover the social issue to address, layout the intervention packages, and partner with governments and investors to issue the bond. Their position is critical in ensuring this system’s success, as they regularly supply the offerings or consequences which can be being funded.

Example:

A non-profit targeted on reducing homelessness may additionally design a software that allows homeless individuals access housing and job training, after which work with the authorities and investors to problem a Social Impact Bond to fund this system.

3. Private Sector Investors

While private buyers do not at once difficulty Social Impact Bonds, they play a important function in funding them. Investors, which can encompass task capitalists, effect investors, or institutional traders, provide the upfront capital required to fund social programs. In alternate, they are paid lower back over time primarily based on the a hit fulfillment of the agreed-upon social results.

Investors benefit from the bond by way of receiving returns on their investments if the social program meets its goals. These returns are normally better than conventional bonds if the effects are met, making SIBs an attractive opportunity for effect-pushed buyers.

You May Also Like: Is it a good idea to invest in savings bonds?

4. Intermediary Organizations

In many cases, intermediary groups are involved in coordinating the issuance of a Social Impact Bond. These intermediaries facilitate relationships between the authorities, provider carriers, and traders. They can be chargeable for handling the assignment, monitoring results, and ensuring transparency during the method.

Intermediaries help structure the economic elements of SIBs and are essential for ensuring that traders are paid only whilst the favored consequences are met. Their position is pivotal in making sure the fulfillment of these bonds, which relies on right assessment and tracking of the social interventions.

5. Philanthropic Organizations

Philanthropic foundations and charitable corporations may additionally play a role in the issuance of SIBs, specifically on the subject of supporting the upfront capital needed to release a social program. These companies regularly act as "first-loss" traders, covering a part of the chance to attract other buyers.

Philanthropic involvement can assist bridge the investment gap, in particular for social applications that concentrate on marginalized or inclined populations. Foundations may additionally assist layout the interventions, ensuring that the social impact is significant and aligned with their missions.

Conclusion

Social Impact Bonds are an thrilling device inside the international of social finance, however they require collaboration from multiple sectors to achieve success. Governments, non-income, private traders, and middleman groups all play critical roles in issuing and implementing SIBs. By pooling collectively assets from diverse stakeholders, Social Impact Bonds offer an progressive way to cope with social issues, create sustainable solutions, and pressure fantastic trade.

Whether you're a central authority enterprise seeking to fund social effects or an investor interested in supporting significant causes, the arena of Social Impact Bonds gives ample possibilities for making an effect with your capital.