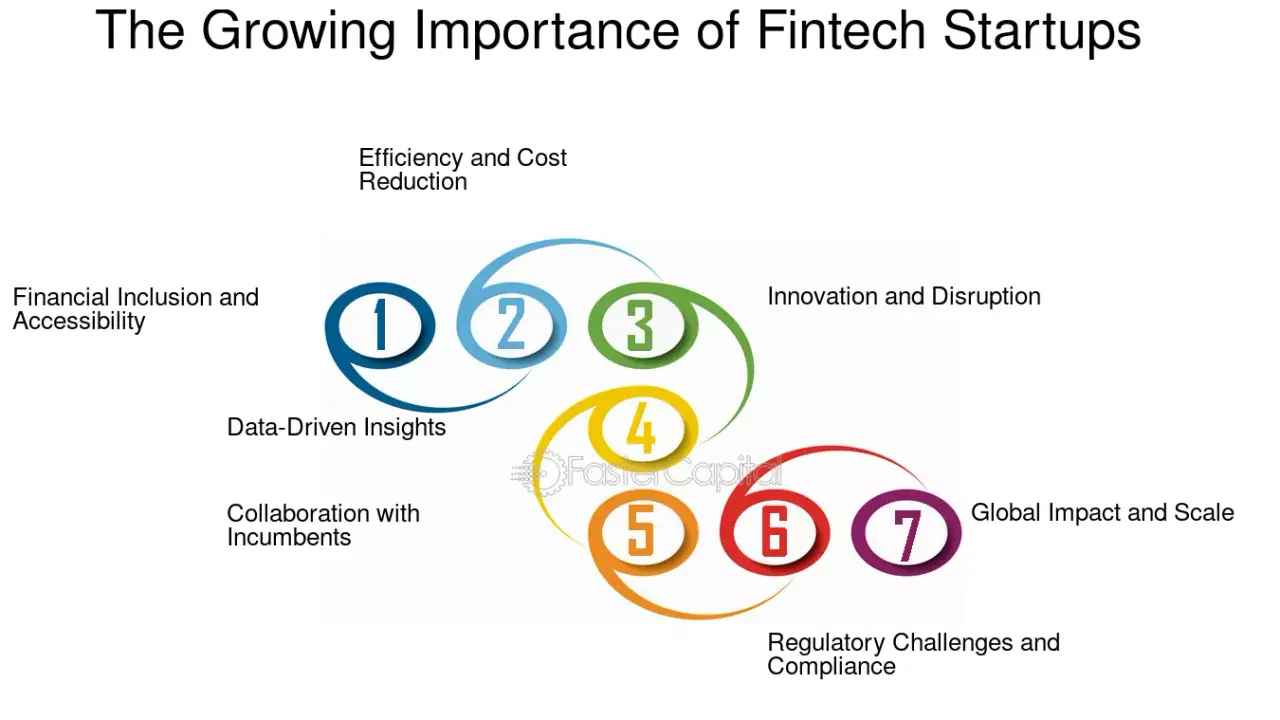

what is relevance of fintech companies in finance? The upward thrust of fintechs has triggered an intensive shift inside the economic paradigm, and purchasers at the moment are tons extra energetic. Fintechs in Spain have gained ground and placed the US. In 6th region worldwide for the quantity of corporations in the region.

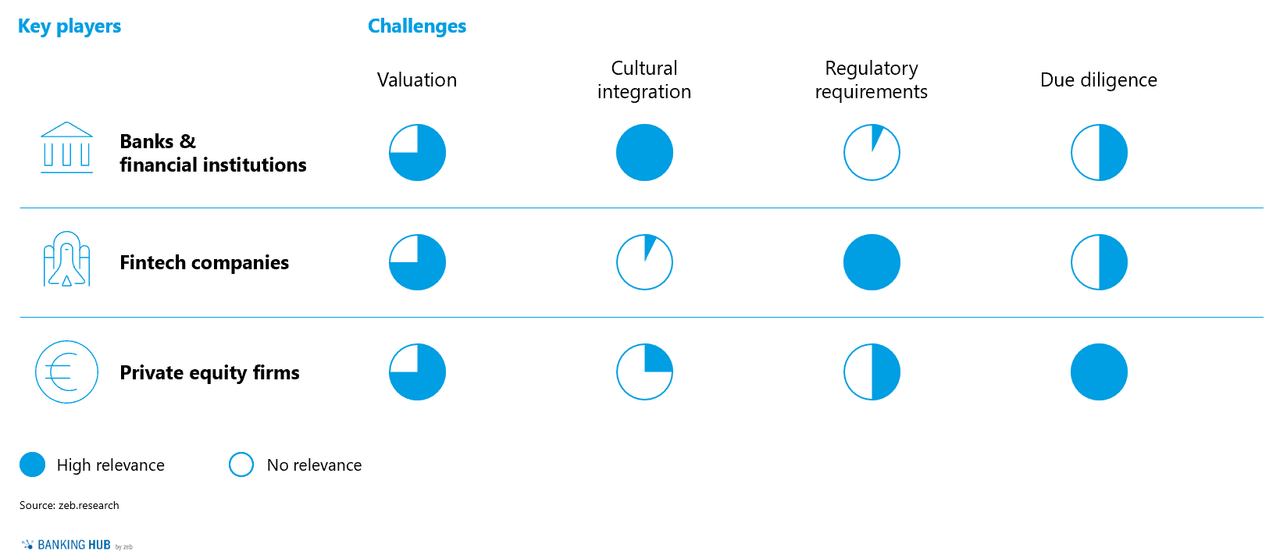

In the new monetary surroundings where the consumer is in most cases virtual and very energetic, conventional economic establishments now not see fintechs as a hazard and now favor to collaborate alternatively.

These collaborations have led to greater balance, a much broader variety of products, and increased information approximately the purchaser. Furthermore, fintechs can provide richer information, an advanced consumer enjoy, and greater modern-day systems.

Together, fintechs and digital banks can provide a fine enjoy to their customers. Their cooperation is fundamental to strengthening the contemporary financial quarter through improving performance and income, generating new business possibilities, enhancing the customer revel in, and growing purchaser loyalty.

What Is Relevance of Fintech Companies in Finance?

In 2021, the fintech zone stood out for its excessive growth and investment figures. In 2022, the sector is anticipated to grow, set new developments, and generate new opportunities to set up new partnerships and reduce chance.

Related Article: How Much Does Fintech Pay in Southwest Florida Roblox?

At the same time, it will open the door to more centralization of offerings around a digital architecture in an effort to put fintechs at the coronary heart of the industry. what is relevance of fintech companies in finance?

But fintechs are not just desirable for traditional financial institutions; they also have many client benefits. According to GDS Link,

The foremost advantages fintechs have for consumers consist of:

Personalized service: They provide unique monetary services and products adapted to customers’ needs.

Convenience and velocity: they could offer actual-time, 24-hour offerings each day of the year.

Easy access: Easy access to efficient, agile, and simple paperless operations with out leaving the house.

Technology: It can guarantee the veracity and protection of transactions from any device.

Financial inclusion and democratisation of access to economic products. Access to economic products does not ought to be in character and may be virtual, thereby enhancing economic inclusion.

Transparency and less charges.New services and products. Whether mobile payments, automated advice, get entry to to credit score through a collaborating platform, and so forth.

Read Also: How to Avoid Capital Gains Tax on Cryptocurrency?

The rise of fintechs has precipitated a radical shift in the economic paradigm. Consumers are now not passive and still have expectations. If they're not satisfied, they can alternate vendors with relative ease.

According to the current World Retail Banking Report 2022 (WRBR) by Capgemini and Efma, “seventy five% of customers surveyed are drawn to Fintech’s cost-powerful and seamless services, significantly elevating their virtual banking expectations.

However, in keeping with their study, “it is crucial banks higher leverage information and Artificial Intelligence to tailor the enjoy, create stronger connections and maximise purchaser price” because these days, customers are “capable of switch carriers at the faucet of a display.” What is relevance of fintech companies in finance?

In the present day monetary ecosystem that demands an increasing number of quicker services, figuring out, assessing, and stopping capacity dangers or vulnerabilities is a top priority. For fintechs, sturdy cybersecurity is an absolute have to for verbal exchange, transparency, and instilling self belief in customers whilst dealing with their finances.

Related Post: What Happens if I Buy Tesla Stock Today 11th March 2025?

The success of fintechs is basically because they're a whole lot greater than just price platforms. They provide computerized processes and a huge variety of tailor-made products and services that improve the client enjoy.

However, those clients aren't immune from the inherent risks of monetary crime. According to García Rouco, coping with director at GDS Link, “ a permanent and persevering with mission for fintechs can be to guarantee safety, and continually being prepared for the potential risks is the quality shape of protection.”

what is relevance of fintech companies in finance? The upward thrust of fintechs has triggered an intensive shift inside the economic paradigm, and purchasers at the moment are tons extra energetic. Fintechs in Spain have gained ground and placed the US. In 6th region worldwide for the quantity of corporations in the region.

In the new monetary surroundings where the consumer is in most cases virtual and very energetic, conventional economic establishments now not see fintechs as a hazard and now favor to collaborate alternatively.

These collaborations have led to greater balance, a much broader variety of products, and increased information approximately the purchaser. Furthermore, fintechs can provide richer information, an advanced consumer enjoy, and greater modern-day systems.

Together, fintechs and digital banks can provide a fine enjoy to their customers. Their cooperation is fundamental to strengthening the contemporary financial quarter through improving performance and income, generating new business possibilities, enhancing the customer revel in, and growing purchaser loyalty.

What Is Relevance of Fintech Companies in Finance?

In 2021, the fintech zone stood out for its excessive growth and investment figures. In 2022, the sector is anticipated to grow, set new developments, and generate new opportunities to set up new partnerships and reduce chance.

Related Article: How Much Does Fintech Pay in Southwest Florida Roblox?

At the same time, it will open the door to more centralization of offerings around a digital architecture in an effort to put fintechs at the coronary heart of the industry. what is relevance of fintech companies in finance?

But fintechs are not just desirable for traditional financial institutions; they also have many client benefits. According to GDS Link,

The foremost advantages fintechs have for consumers consist of:

Personalized service: They provide unique monetary services and products adapted to customers’ needs.

Convenience and velocity: they could offer actual-time, 24-hour offerings each day of the year.

Easy access: Easy access to efficient, agile, and simple paperless operations with out leaving the house.

Technology: It can guarantee the veracity and protection of transactions from any device.

Financial inclusion and democratisation of access to economic products. Access to economic products does not ought to be in character and may be virtual, thereby enhancing economic inclusion.

Transparency and less charges.New services and products. Whether mobile payments, automated advice, get entry to to credit score through a collaborating platform, and so forth.

Read Also: How to Avoid Capital Gains Tax on Cryptocurrency?

The rise of fintechs has precipitated a radical shift in the economic paradigm. Consumers are now not passive and still have expectations. If they're not satisfied, they can alternate vendors with relative ease.

According to the current World Retail Banking Report 2022 (WRBR) by Capgemini and Efma, “seventy five% of customers surveyed are drawn to Fintech’s cost-powerful and seamless services, significantly elevating their virtual banking expectations.

However, in keeping with their study, “it is crucial banks higher leverage information and Artificial Intelligence to tailor the enjoy, create stronger connections and maximise purchaser price” because these days, customers are “capable of switch carriers at the faucet of a display.” What is relevance of fintech companies in finance?

In the present day monetary ecosystem that demands an increasing number of quicker services, figuring out, assessing, and stopping capacity dangers or vulnerabilities is a top priority. For fintechs, sturdy cybersecurity is an absolute have to for verbal exchange, transparency, and instilling self belief in customers whilst dealing with their finances.

Related Post: What Happens if I Buy Tesla Stock Today 11th March 2025?

The success of fintechs is basically because they're a whole lot greater than just price platforms. They provide computerized processes and a huge variety of tailor-made products and services that improve the client enjoy.

However, those clients aren't immune from the inherent risks of monetary crime. According to García Rouco, coping with director at GDS Link, “ a permanent and persevering with mission for fintechs can be to guarantee safety, and continually being prepared for the potential risks is the quality shape of protection.”