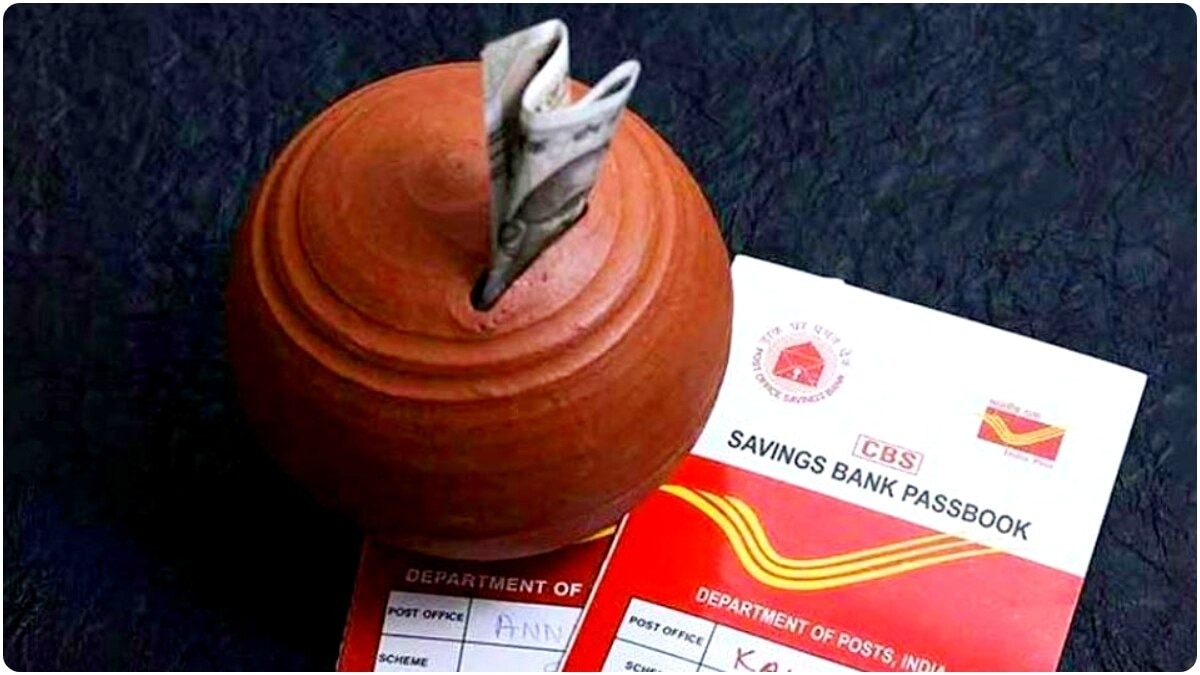

Here’s a detailed blog-fashion evaluate of the interest costs on Post Office Small Savings Schemes in India for July–September 2025, followed with the aid of context on how these are set, why they’re unchanged, and what it way for buyers.

Read Also: Is the stock market open on juneteenth?

Latest Interest Rates 1 July – 30 September 2025

As in keeping with the Ministry of Finance notification issued on 30 June 2025, small financial savings hobby fees continue to be unchanged for the sector—marking the sixth consecutive quarter of balance

Scheme Interest Rate

(Source: Ministry circular and a couple of media reports)

Why the Rates Are Still Steady?

Quarterly Revision Based on G‑sec Yields

Rates are adjusted quarterly in line with the Shyamala Gopinath Committee’s recommendation—commonly 25–one hundred bp above relevant authorities bond yields

Despite RBI’s 1% Repo Rate Cuts, bond yields dropped handiest modestly, so the authorities chose to maintain quotes to ensure continuity

Stability for Investors: Especially beneficial for retirees and danger-aware savers, the consistency helps in monetary making plans with fixed, guaranteed returns .

How These Schemes Compare & Who They Suit Best?

Safety & Backing: Government-assured, making them low-chance options.

Senior Citizens:

SCSS gives a lucrative 8.2% interest fee, higher than many everyday bank FDs (e.G., SBI ~7.Five%)

Women’s Savings Goals:

SSY at eight.2% supports education and marriage planning for ladies.

Regular Income Seekers:

MIS presents a solid month-to-month interest payout at 7.4%.

Long-Term Tax Saving:

PPF gives 7.1%, with tax benefits underneath Section 80C.

You May Also Like: What are the best practices for email marketing campaigns?

Versatile Fixed Deposits:

Post Office TDs provide anywhere from 6.Nine% to 7.5%, relying on tenure.

What This Means for You?

If you already invested: Your returns will hold at the equal costs till 30 September 2025.

If you’re making plans to invest: This sector offers a steady entry point with appealing, steady returns.

Bond marketplace watchers: Future fee cuts may comply with similarly drops in bond yields—watch out for the next area's update in overdue September 2025

Scheme Selector: Which Option Fits You?

The unchanged interest fees on Post Office Small Savings Schemes from July 1 to September 30, 2025, reveal a planned flow to ensure financial predictability and safety for tens of millions of Indian savers . Whether you’re seeking fixed profits, tax-saving units, or lengthy-time period investments, those schemes stay sound and available picks.

Here’s a detailed blog-fashion evaluate of the interest costs on Post Office Small Savings Schemes in India for July–September 2025, followed with the aid of context on how these are set, why they’re unchanged, and what it way for buyers.

Read Also: Is the stock market open on juneteenth?

Latest Interest Rates 1 July – 30 September 2025

As in keeping with the Ministry of Finance notification issued on 30 June 2025, small financial savings hobby fees continue to be unchanged for the sector—marking the sixth consecutive quarter of balance

Scheme Interest Rate

(Source: Ministry circular and a couple of media reports)

Why the Rates Are Still Steady?

Quarterly Revision Based on G‑sec Yields

Rates are adjusted quarterly in line with the Shyamala Gopinath Committee’s recommendation—commonly 25–one hundred bp above relevant authorities bond yields

Despite RBI’s 1% Repo Rate Cuts, bond yields dropped handiest modestly, so the authorities chose to maintain quotes to ensure continuity

Stability for Investors: Especially beneficial for retirees and danger-aware savers, the consistency helps in monetary making plans with fixed, guaranteed returns .

How These Schemes Compare & Who They Suit Best?

Safety & Backing: Government-assured, making them low-chance options.

Senior Citizens:

SCSS gives a lucrative 8.2% interest fee, higher than many everyday bank FDs (e.G., SBI ~7.Five%)

Women’s Savings Goals:

SSY at eight.2% supports education and marriage planning for ladies.

Regular Income Seekers:

MIS presents a solid month-to-month interest payout at 7.4%.

Long-Term Tax Saving:

PPF gives 7.1%, with tax benefits underneath Section 80C.

You May Also Like: What are the best practices for email marketing campaigns?

Versatile Fixed Deposits:

Post Office TDs provide anywhere from 6.Nine% to 7.5%, relying on tenure.

What This Means for You?

If you already invested: Your returns will hold at the equal costs till 30 September 2025.

If you’re making plans to invest: This sector offers a steady entry point with appealing, steady returns.

Bond marketplace watchers: Future fee cuts may comply with similarly drops in bond yields—watch out for the next area's update in overdue September 2025

Scheme Selector: Which Option Fits You?

The unchanged interest fees on Post Office Small Savings Schemes from July 1 to September 30, 2025, reveal a planned flow to ensure financial predictability and safety for tens of millions of Indian savers . Whether you’re seeking fixed profits, tax-saving units, or lengthy-time period investments, those schemes stay sound and available picks.